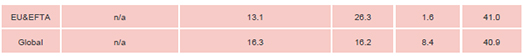

Ireland’s tax system ranks as the most effective in the EU for paying business taxes – World Bank Group report confirms. Ireland has an effective corporate tax rate of 12.4% compared to an EU average of 13.1% and 16.3% globally.

Ireland continues to be the most effective country in the EU to pay business taxes and the sixth most effective in the world. This means that Ireland’s tax system continues to be one of the most efficient in terms of bureaucracy and administrative burden when it comes to paying, filing, time spent and the amount of tax levied on businesses. For example, Irish companies on average spend 80 hours complying with the tax regime compared to 218 hours in Germany. This is according to a report issued by the World Bank Group entitled ‘Paying Taxes 2015’. The report covers 189 economies worldwide and looks at all taxes paid by businesses.

It is interesting to compare the effective corporate tax rates (see chart below) compared to the statutory corporate tax rates.

According to the study, a typical Irish company spends nearly half of its total commercial profit in taxes, spends two weeks dealing with its tax affairs and makes a tax payment nearly every six weeks. Globally this compares to the typical company paying over a third of its commercial profit in taxes, spending over seven weeks dealing with its tax affairs and making a tax payment every 2 weeks.

The ranking by The World Bank Group report is unique as it looks beyond corporate income tax to all of the other business taxes paid and is a measure of effectiveness of tax systems around the world. The Paying Taxes 2015 report measures the ease of paying taxes by assessing the administrative burden for companies to comply with tax regulations, and by calculating companies’ total tax liability as a percentage of pre-tax profits. Paying Taxes 2015 measures all mandatory taxes and contributions that a medium-sized company must pay in a given year. Taxes and contributions measured include the profit or corporate income tax, social contributions and labour taxes paid by the employer, property taxes, property transfer taxes, dividend tax, capital gains tax, financial transactions tax, waste collection taxes, vehicle and road taxes and other small taxes such as fuel taxes etc.

It shows how businesses are affected not only by tax rates, but also by the procedural burden of compliance. The report focuses on three indicators which are used to determine the overall ease of paying taxes which are:

- The cost of taxes, which is measured by the total tax rate (Ireland ranked 4th in the EU with 25.9%); The average Total Tax Rate for the region is 41%. The range of total tax rate for the EU varied from one of the lowest of 20.2% for Luxembourg to the highest of 66.6% for France.

- The time it takes to comply (Ireland ranked 4th in the EU with 80 hours); The average time to comply across the region is 176 hours. The range of total time to comply varied from the one of the lowest of 55 hours for Luxembourg and the highest of 454 hours for Bulgaria.

- The number of tax payments made. Ireland’s number of payments is 9 compared to the average for the region of 12.3

It is interesting to note that for many European countries there is a substantial difference between the statutory corporate headline tax rate and the effective tax rate. However, this is not the case for Ireland with an effective corporate tax rate of 12.4% compared to our statutory corporate tax rate of 12.5%.

Ireland’s ability to cope with multiple tax payments and at the same time to have a system that eases the administrative burden is a credit to our regulatory and tax authorities. Taxes are a significant issue for business and the fact that we continue to hold our rank in this area is critical for continued investment in Ireland.

The survey demonstrates that, having simpler tax systems with competitive business tax rates and a robust and transparent tax regime, gives Ireland a real advantage in the market for attracting direct investment. The survey confirms that Ireland’s tax system is the most effective and straightforward in the EU. While no-one likes paying tax, the Irish tax system makes it relatively easy to comply with the rules and is much less bureaucratic system compared to other EU countries.

The survey further demonstrates that Ireland’s statutory headline rate on profits is broadly similar to the effective rate. The study uses a case study approach so that the same circumstances can be compared across a large number of companies. For many EU countries, the statutory headline rate is significantly higher than the effective rate. When you take labour and other taxes into account, Ireland’s total tax rate on corporate profits is much lower (25.9%) when compared with other EU countries (EU average: 41%)

“One of the reasons why Ireland leads in the EU as the most effective country to deal with taxes is due to the Revenue continuing to make substantial advances in the area of electronic filing and payments and taking a proactive approach to making it ‘easier’ for companies and individuals to deal with their obligations.”

Ireland’s transparent tax regime and low corporate tax rate together with the relative ease to pay tax is vital in continuing to underpin the positioning of Ireland as a location of choice for foreign direct investment. This transparency and relative ease to pay taxes together with 72 treaties and world class R&D tax credit system are important elements in providing us with an opportunity to help multinational corporations establish operations in Ireland as well as expand their operations here.

|

|

The table below shows how Ireland compares to some other countries in the EU in terms of Total Tax Rate (from left to right; Profit tax; Labour tax and other taxes) showing Ireland’s profit tax to be 12.4% compared to 4.2% for Luxembourg, 7.4% for France, 20.9% for the UK and 23.3% for Germany. The chart also shows the Statutory corporate tax rate.

Note: Please note in the above chart that there may be multiple statutory corporate tax rates for individual countries ie varying local trade taxes, communal taxes, solidarity taxes etc.

Economic analysis featured in the report shows that economies where action was taken to reduce complexity in tax administration – both in terms of the number of payments and the time taken with tax matters – there has tended to be higher economic growth.

Top 10 rankings for the EU countries on ease of paying taxes are, in order, are: Ireland, Denmark, Norway, UK, Switzerland, Luxembourg, Finland, Netherlands, Latvia and Malta.

The top 10 worldwide economies for ease of paying taxes are, in order: Joint first: Qatar and United Arab Emirates, Saudi Arabia, Hong Kong, Singapore, Ireland, Macedonia, Bahrain, Canada and Oman.

Globally, tax reform is set to remain an important topic for governments for some years to come, and this will include the need to take on board the proposals from the OECD to modernise the international tax system to cater for today’s globalised business in a digital world. The Irish Minister for Finance has in our recent Budget dynamically changed the environment by changing the rules to the ‘double Irish’ without impacting in any way on the substantive investment here. Ireland is a strong, transparent, open, rules based system. That means that no matter who you are, what you do and where you do it in the country, you get the same tax answer. As confirmed by the survey, Ireland is in a really good place at the moment.